Increase in Pensions

The Retirees Basic Need: An Increase in Pensions

CORRE's Request:

An increase in pension for all pensioners that will restore a meaningful amount of the purchasing power lost by their pensions during retirement.

Discussion

There is no disagreement about the erosive impact of inflation and the resulting loss of purchasing power of pensions that are not adjusted for increases in the cost of living. Moreover, there is no disagreement that many Oak Ridge pensioners suffer financially, especially those with long tenure in retirement. They are trapped—trapped by inflationary loss in purchasing power, by the lack of cost-of-living adjustments to counter inflationary losses, and by the recent economic downturn which effectively decreased the amount and the value of their savings.

The extent of inflationary loss is reflected by the following data, as of December 31, 2012. These data include all past pension adjustments.

| Retirement Year | Purchasing Power Lost During Retirement |

|---|---|

| 1970 | 62% |

| 1980 | 47% |

| 1990 | 34% |

| 2000 | 25% |

| 2010 | 4% |

The last general increase in pensions was implemented on April 1, 2001, but was given only to those who retired prior to April 1998. Retirees who retired after March 1998 have never received a pension adjustment.

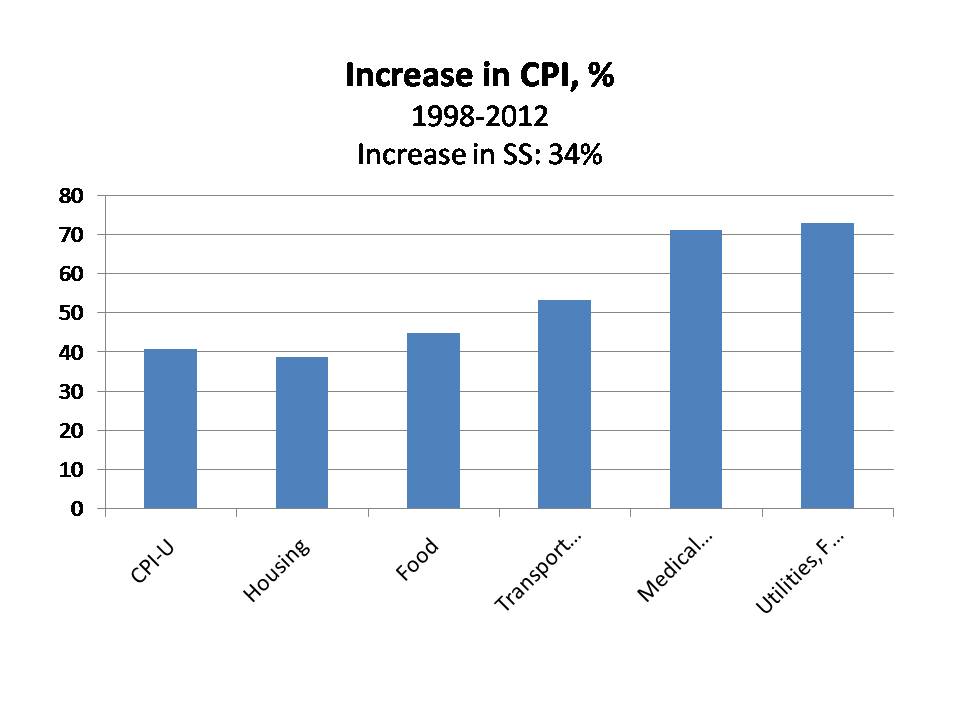

According to a recent study by the Bureau of Labor Statistics, senior citizens are hurt more by rising costs of living than are non-senior citizens. This is due largely to the fact that the costs of essentials such as food, energy, and especially health care, increase faster than costs expressed by the composite Consumer Price Index. The following bar chart clearly reflects this point, for the time period April 1998 through December 2012. The last adjustment was given to those who retired before April 1998.

It is notable that the composite CPI-U increased 41% and Social Security benefits increased by 34% during the same interval. These data are truly telling when compared with zero change in Oak Ridge pensions. Clearly, the absence of pension adjustments over the fourteen-year period has resulted in bleak circumstances for many retirees, especially those with long tenure in retirement.

CORRE has encountered a variety of arguments against its request for a pension adjustment over the past fifteen years. When the MEPP trust was well-funded, the argument was that a surplus is needed in case of a financial downturn. When the trust was under-funded, the argument was that there is no money for adjustments. When the trust was level-funded, the argument was that projections indicate that contributions may be required in the future.

Today, late in 2014, the economy has recovered from the recession, inflation is low, and the stock market is operating at historically high levels. However, uncertainty remains regarding the national debt and the impact of pending changes in the Congress. We continue to be told that this is not an appropriate time to be seeking improvements in retirement plans and that retiree needs can only be addressed when trusts are fully funded and budgets are stable. Trusts funding levels are approaching 100% now, but budgets are seldom stable.

An important, but often overlooked, fact is that pension benefits are held in and distributed from pension trusts, not operating funds. Contractors may add funding to these trusts to build or maintain funding levels. Contractors are responsible for proposing changes in benefits. DOE retains approval rights.

CORRE has consistently advocated for adjustments based on recovery of a fixed percentage of inflationary loss in pension value. We believe this straight-forward approach to be imminently fair to all concerned.

CORRE developed a simple method for computing such adjustments as a function of retirement year. Regardless of approach, the basic need of retirees and surviving spouses remains a significant increase in pension.